Added China’s $48 Billion Semiconductor Fund - May 27 2024

In a bold move to bolster its position in the global semiconductor market, South Korea has

announced a massive 26 trillion won ($19 billion) support package for its chip industry. President Yoon Suk Yeol emphasized the critical nature of this sector, stating that semiconductors are a field where "all-out national warfare is underway." The success or failure of a nation in this arena, he added, depends on who can produce cutting-edge semiconductors first.

We have created a comprehensive support programme for the semiconductor industry worth 26 trillion Korean won [$19.1bn], which encompasses financial, infrastructure, research and development, as well as support for small and medium-sized companies

A week after the South Korea announcement, China also announced raising a whopping $48 billion for its third national semiconductor fund. Known as the "Big Fund," this state-owned initiative aims to bolster China's semiconductor industry, which is crucial for the country's vision of achieving self-sufficiency in cutting-edge technologies. The U.S. has been tightening its grip on the export of advanced semiconductors and chip-manufacturing equipment to China. This has created a dire need for China to ramp up its domestic capabilities.

Established in 2014, the National Integrated Circuit Industry Investment Fund, or the "Big Fund," plays a pivotal role in developing China's semiconductor-supply chain. The third tranche of this fund, registered recently, sees China’s Ministry of Finance as the largest investor. Key stakeholders include state-owned banks and investment vehicles from prominent cities like Shanghai, Beijing, and Shenzhen.

South Korea Boosting Market Share and Competitiveness

The support package includes a 17 trillion won ($12.5 billion) financial support program facilitated through the state-run Korea Development Bank. This initiative aims to encourage investments in semiconductor production, allowing companies to allocate substantial funds for new factories and production line expansions. Additionally, a 1 trillion won ($734 million) "semiconductor ecosystem fund" will be established to support equipment makers and fabless companies, helping to bridge the gap between South Korean chip makers and their Taiwanese competitors, such as TSMC.

South Korea, despite being home to world-leading memory chip manufacturers like Samsung and SK Hynix, has lagged behind in areas such as chip design and contract manufacturing. The country's fabless sector, which focuses on chip design while outsourcing production, currently holds only about 1% of the global market. To address this disparity, the government has set a goal to increase South Korea's market share in non-memory chips, such as mobile application processors, from 2% to 10%.

In addition to the financial support package, South Korea is developing a major chipmaking complex in Yongin, near Seoul. This mega cluster is intended to attract equipment manufacturers and fabless companies, further strengthening the country's semiconductor ecosystem. To expedite the construction process, the government has pledged to cut bureaucratic red tape and streamline procedures, allowing the complex to be built at twice the normal rate.

Semiconductors are South Korea’s leading export and hit $11.7bn in March, their highest level in almost two years, accounting for a fifth of South Korea’s total exports, according to trade ministry figures. It is important to note that the majority of South Korea's package will be invested in chip manufacturing rather than research and development or chip design.

The AI Boom: Taiwan TSMC will grow by approximately 10% this year

The AI boom is closely tied to the evolution of advanced semiconductor technologies, which are necessary to meet the ever-growing demand for computing power. Taiwan Semiconductor Manufacturing Co (TSMC), the world's largest contract chipmaker, predicts that global semiconductor revenue will grow by approximately 10% this year, excluding the memory chip sector. This growth is attributed to several factors:

- Strong AI server demand: The demand for AI servers is expected to be 2.5 times higher than last year, according to TSMC deputy cochief operating officer Cliff Hou.

- Recovery in smartphone and PC demand: Shipments of smartphones and PCs are estimated to increase by 1-3% this year, signaling a mild recovery from the prolonged inventory-driven slump.

- Foundry sector growth: The foundry sector, where TSMC holds a 60% market share, is expected to grow even faster, with an annual pace of 15-20% by revenue.

Nvidia, TSMC's most important customer in the high-performance-computing (HPC) area, has seen the computing power of its new Blackwell graphics processing unit (GPU) for servers, made on TSMC's 4-nanometer technology, soar 1,000 times compared to its previous GPU made on 7-nanometer technology just four or five years ago.

TSMC's 3-nanometer Expansion Plans

According to Huang Yuan-kuo, head of TSMC's FAB18 plant in Tainan, the production capacity of the company's cutting-edge three-nanometer process is expected to triple in 2023 compared to the previous year. In addition to its leading-edge processes, TSMC is also expanding its production capacity for specialty technology. The proportion of specialty technology relative to all mature processes is projected to grow from 61 percent in 2020 to 67 percent in 2024.

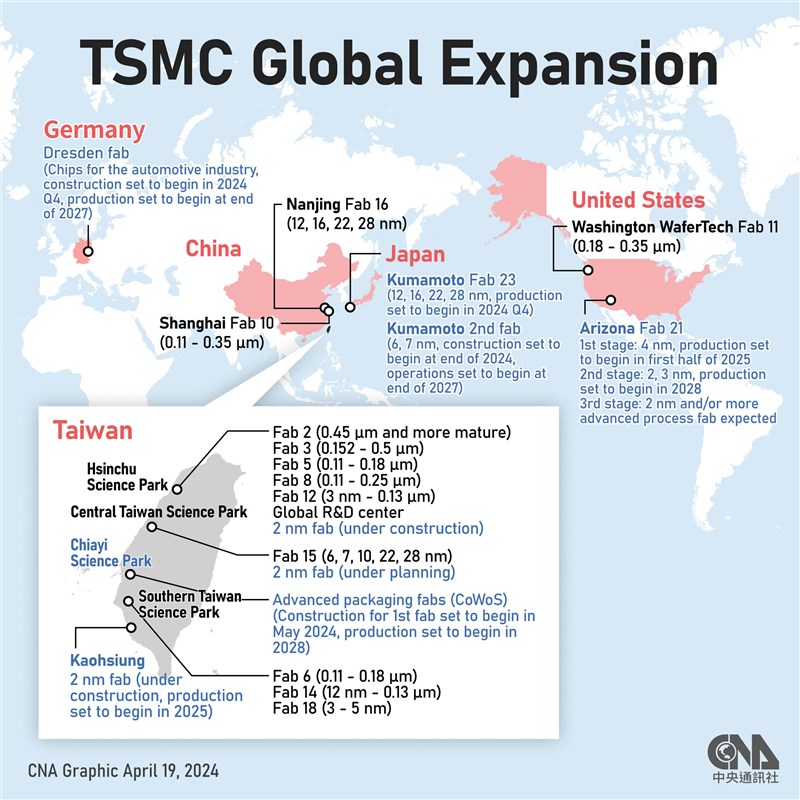

To maintain its technological leadership, TSMC is constructing two new wafer plants in Hsinchu and Kaohsiung, which will manufacture chips using the company's next-generation 2-nanometer process. Construction of these plants began in 2022, and mass production is scheduled to commence in 2025. The 2nm process will offer significant improvements in performance, power efficiency, and density compared to the current 3nm process.

TSMC is also investing in advanced packaging technologies to meet the growing demand for heterogeneous integration and system-level solutions. The company is building an advanced packaging factory in Central Taiwan, which began construction last year. Another packaging factory is planned for Chiayi, with construction set to start later this year. These factories will mass-produce Chip on Wafer on Substrate (CoWoS) and Small Outline Integrated Circuit (SoIC) technologies starting in 2026.

Japan's $36 Billion Investment in Semiconductors

In recent years, Japan has been making significant strides in the semiconductor industry, investing heavily to secure its position as a global leader. From fiscal 2021 to 2023, the Japanese government allocated an impressive ¥3.9 trillion (approximately $36 billion) to support its semiconductor industry.

Japan's investment in the semiconductor industry is not only substantial but also strategic. The country has allocated funds to support both foreign and domestic chipmakers, ensuring a diverse and robust semiconductor ecosystem, including a ¥1.2 trillion to TSMC for building a plant in Kikuyo, Kumamoto Prefecture. Also, the ¥920 billion to Rapidus, a Japanese chipmaker focused on developing next-generation semiconductor technology.

When compared to other countries, Japan's investment in the semiconductor industry is proportionally higher. The United States, for example, allocated ¥7.1 trillion (approximately $65 billion) over a five-year period, which represents only 0.21% of the country's GDP. In contrast, Japan's investment of ¥3.9 trillion is equivalent to 0.71% of its GDP, more than three times the proportion of the United States.

Germany, another major player in the semiconductor industry, invested ¥2.5 trillion (approximately $23 billion), which amounts to 0.41% of its GDP. While still significant, Germany's investment falls short of Japan's proportional commitment to the industry. See the summary chart from

nippon.com:

China Big Fund for Semiconductor

The Big Fund’s past performance has seen both leaps in progress and significant setbacks. In its first phase, the fund raised about 138.7 billion yuan (around $19 billion), focusing primarily on fortifying the general chip-making capabilities of the nation. By 2019, a new round amassed around $28 billion to continue this mission. However, alongside these successes, the fund has also faced corruption allegations and the failure of several high-profile projects, illustrating the challenges of state-driven technological advancements.

According to

WSJ, analysts suggest that the latest fund will continue to focus heavily on manufacturing, given its enormous financial requirements. However, it is expected to extend support to other critical sectors, such as advanced high-bandwidth memory chips—a segment where China currently lacks production capabilities. Technology advancement and production capacity for older technology chips used in automobiles and electronics are also likely to receive substantial attention.

- Manufacturing: Focus on the massive financial investments required for scaling production.

- Advanced High-Bandwidth Memory Chips: Promoting technological advancements in sectors where China is currently lagging.

- Legacy Technology Chips: Increasing production capacity to remain competitive in global markets.

The Future of the Semiconductor Industry

Japan's semiconductor industry has a rich history, with six Japanese general electronics manufacturers, including NEC, Toshiba, Hitachi, and Fujitsu, ranking in the top 10 for global semiconductor sales back in 1989. However, the emergence of South Korean manufacturers and various other factors led to a gradual decline in Japan's competitive power throughout the late 1990s and 2000s.

Despite several attempts to revive the industry through mergers, joint ventures, and national policy projects, Japan struggled to regain its previous global standing. However, with the recent massive investment and renewed focus on cutting-edge semiconductor technology, Japan is poised to make a comeback in the industry.

TSMC's aggressive expansion plans demonstrate the company's commitment to staying at the forefront of semiconductor technology and meeting the ever-increasing demand for advanced chips. By tripling its 3nm capacity, expanding specialty technology, growing its automotive platform solutions, and investing in 2nm and advanced packaging technologies, TSMC is well-positioned to maintain its leadership in the global semiconductor industry and support the growth of its customers across various sectors.

China’s third installment of the Big Fund is a robust signal that Beijing is doubling down on its semiconductor ambitions. With investments targeting the entire industrial chain of integrated circuits, the country aims to make meaningful strides in technological self-sufficiency. This fund, combined with strategic state support mechanisms, has the potential to propel China into the upper echelons of the global semiconductor industry.

The semiconductor industry is poised for significant growth in the coming years, driven by the increasing demand for AI, HPC, and mobile devices. One thing is certain: Taiwan, South Korea, China, and Japan's bold moves has the potential to redefine the industry and drive innovation for years to come.

Recent Posts